Commercial Law League of America

A not-for-profit association providing networking opportunities, education, and results to creditors’ rights attorneys, bankruptcy attorneys, commercial collection agencies, and legal network personnel.

Find A CLLA Attorney

Find A CLLA Certified Agency

Find A CLLA Agency

Find A CLLA Professional

Commercial Law League of America

Find A CLLA Attorney

Find A CLLA Agency

Find A CLLA Certified Agency

Find A CLLA Professional

NEW! The Briefing Room- an exclusive CLLA online member community. Click here for more details.

NEW! The Briefing Room- an exclusive CLLA online member community. Click here for more details.

Who We Are

The Commercial Law League of America (CLLA) is a not-for-profit association of creditors’ rights attorneys, bankruptcy attorneys, commercial collection agencies, and legal network personnel.

CLLA is dedicated to providing networking opportunities, education, and results to its members. Active in legislative advocacy, members also lobby Congress to protect the rights of creditors and businesses. CLLA Bankruptcy Section members have provided numerous Amicus Briefs and position papers as well as testified before Congressional committees on bankruptcy issues.

CLLA provides an online membership directory, Find A CLLA Professional, that provides a direct link and location to commercial lawyers, commercial collection agencies, legal networks, and paralegals.

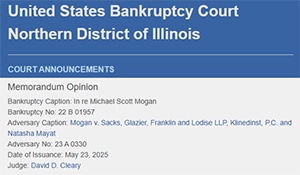

ILNB Newsletter: Opinion – Mogan v. Sacks, Glazier, Franklin,Lodise LLp (In re Michael Scott Mogan) 23 A 330

U.S. Courts sent this bulletin at 05/29/2025 11:43 AM EDT

CLICK HERE TO READ MORE

The Commercial Collection Agency Certification Program – Setting the Standard for Excellence

The CLLA Commercial Collection Agency Certification Program has been setting the standard for 50 years. Look for the Seal…It’s not just a badge of honor, it’s a commitment to excellence and a promise of superior service. You can count on a CLLA-Certified Agency not only for effective debt recovery but for long-term stability and success in your business dealings. For more information, visit www.CLLACertified.org.

Who We Are

The Commercial Law League of America (CLLA) is a not-for-profit association of creditors’ rights attorneys, bankruptcy attorneys, commercial collection agencies, and legal network personnel.

CLLA is dedicated to providing networking opportunities, education, and results to its members. Active in legislative advocacy, members also lobby Congress to protect the rights of creditors and businesses. CLLA Bankruptcy Section members have provided numerous Amicus Briefs and position papers as well as testified before Congressional committees on bankruptcy issues.

CLLA provides an online membership directory, Find A CLLA Professional, that provides a direct link and location to commercial lawyers, commercial collection agencies, legal networks, and paralegals.

ILNB Newsletter: Opinion – Mogan v. Sacks, Glazier, Franklin,Lodise LLp (In re Michael Scott Mogan) 23 A 330

U.S. Courts sent this bulletin at 05/29/2025 11:43 AM EDT

CLICK HERE TO READ MORE

The Commercial Collection Agency Certification Program – Setting the Standard for Excellence

The CLLA Commercial Collection Agency Certification Program has been setting the standard for 50 years. Look for the Seal…It’s not just a badge of honor, it’s a commitment to excellence and a promise of superior service. You can count on a CLLA-Certified Agency not only for effective debt recovery but for long-term stability and success in your business dealings. For more information, visit www.CLLACertified.org.